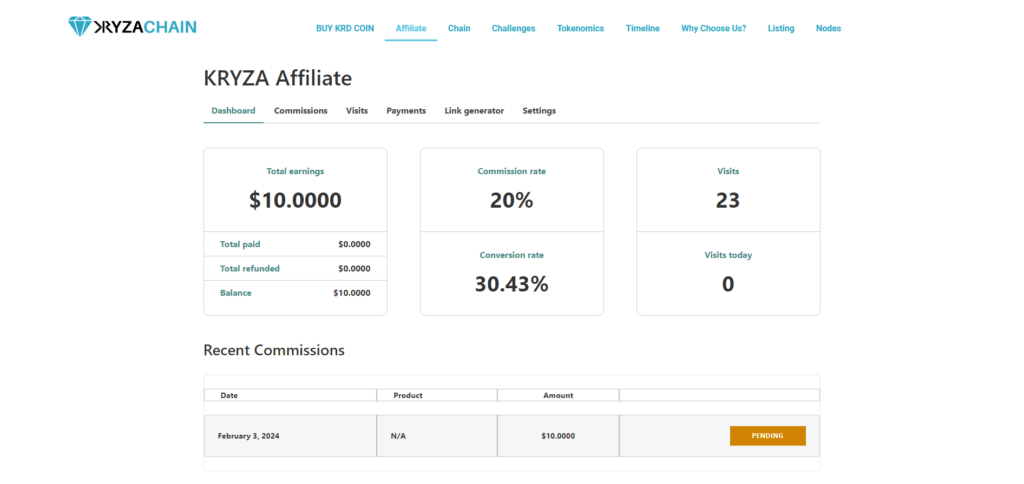

Are you ready to delve into the exciting world of cryptocurrency and blockchain technology? Look no further than KRYZA Diamond Chain Coin (symbol: KRD). In this article, we’ll explore the groundbreaking features of KRD and how it’s revolutionizing the digital landscape. But before we dive in, here’s a special announcement for our readers: Did you know that we offer an affiliate program where you can earn a whopping 20% commission through your referral link for purchases made? Now, let’s embark on this journey of discovery.

AFFILIATE Portal: https://presale.kryza.io/affiliate/

Unveiling KRYZA Diamond Chain Coin

At the heart of our blockchain ecosystem lies the KRYZA Diamond Chain, and its flagship cryptocurrency, KRYZA Diamond Coin (KRD). Built on the KRYZA Chain (KRC20), KRD boasts an astonishingly fast average block time of just 3 seconds, ensuring seamless and swift transactions for users. What’s more, KRD is engineered to be invulnerable to 51% attacks, ensuring the security and integrity of transactions on our platform.

The Presale Journey and Beyond

Exciting opportunities await early adopters of KRD. Our presale offers participants exclusive access to acquire KRD tokens before they hit major exchanges. Plus, here’s a thrilling update: proceeds from the presale will contribute to our listing on the prestigious MEXC exchange. Rest assured, your investment will fuel our journey towards greater heights, as we’ve already undertaken significant development initiatives using our own resources.

Empowering Innovation with KRYZA Diamond

KRYZA Diamond isn’t just another cryptocurrency—it’s a catalyst for innovation. With its lightning-fast and cost-effective blockchain, KRYZA Diamond opens doors to a myriad of applications, from social media platforms to gaming and beyond. Developers are invited to leverage the versatility of KRYZA Diamond to pioneer groundbreaking solutions on our platform.

Interoperability and Security

We understand the importance of seamless connectivity in the digital age. That’s why KRYZA Diamond is committed to interoperability, with plans underway to develop bridge solutions that enable smooth transitions between different blockchain networks. Our priority is to empower cryptocurrency enthusiasts worldwide with secure and cost-effective exchanges.

Charting the Course Ahead

But our journey doesn’t stop here. We’re continually evolving, with ambitious plans to enhance our decentralized and centralized exchange platforms, integrate the KRYZA Network into our social media ecosystem, and much more. Stay tuned as we revolutionize the way the world interacts with blockchain technology.

Join the KRYZA Diamond Community

As we celebrate our 3rd anniversary, we invite you to join us on this exhilarating journey. Whether you’re a seasoned cryptocurrency enthusiast or a curious newcomer, there’s a place for you in the KRYZA Diamond community. Together, let’s shape the future of blockchain innovation.

Conclusion

In conclusion, KRYZA Diamond Chain Coin (KRD) represents more than just a cryptocurrency—it’s a testament to our commitment to pushing the boundaries of blockchain technology. With its blazing-fast transaction speeds, unwavering security, and boundless potential for innovation, KRD is poised to lead the charge towards a decentralized future. Join us today and be part of something extraordinary.