Terraform Labs Faces Bankruptcy Following Legal Setbacks In the wake of recent legal challenges, Terraform Labs has succumbed to financial turmoil, officially filing for Chapter 11 bankruptcy in Delaware. A U.S. judge’s determination that LUNA and MIR qualify as securities has compounded the company’s woes, triggering a class action lawsuit in Singapore.

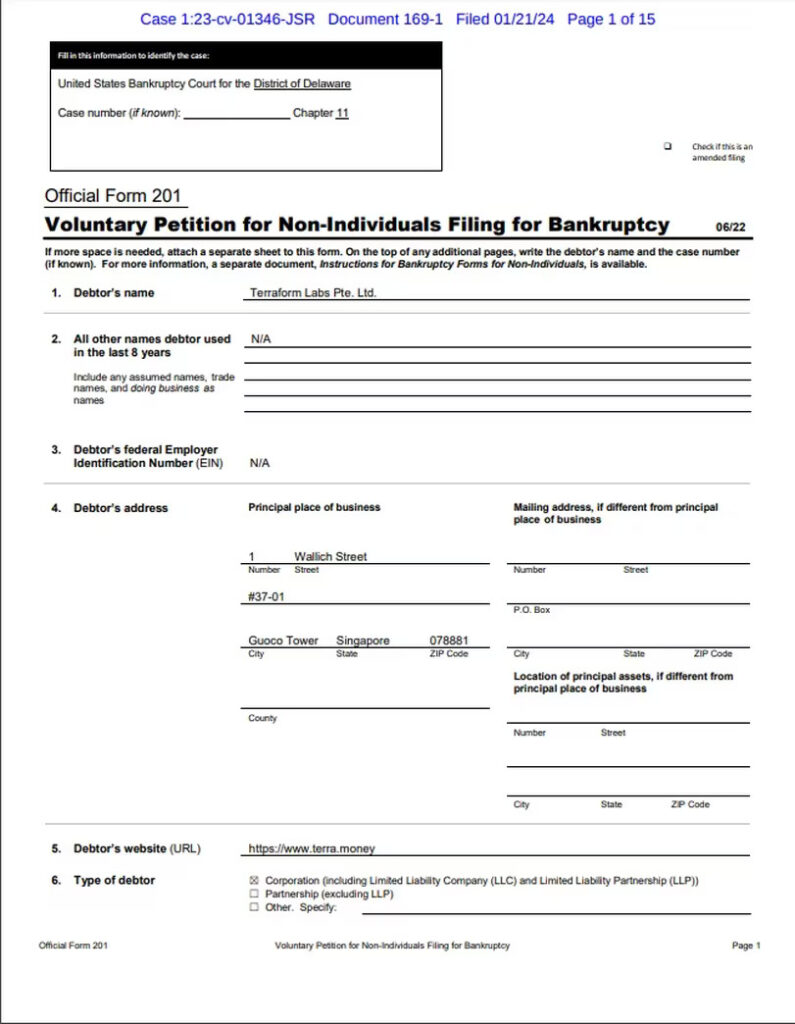

According to documents submitted on January 21, Terraform Labs Pte. initiated a voluntary Chapter 11 bankruptcy petition in Delaware. The filing reveals the company’s estimated assets and liabilities to be within the range of $100 to $500 million. The collapse of TerraUSD, the firm’s ill-fated stablecoin, and the associated downfall of Terra’s LUNA token in May 2022 resulted in the loss of billions of dollars in investor wealth.

In response to the bankruptcy filing, Terraform Labs emphasized its intent to proceed with its business plan amid the ongoing legal challenges. The company stated in a released statement, “The filing will allow TFL to execute on its business plan while navigating ongoing legal proceedings, including representative litigation pending in Singapore and U.S. litigation.”

Key entities listed among the unsecured creditors include TQ Ventures, a U.S.-based digital assets investment fund, and Standard Crypto, a venture fund headquartered in San Francisco.

Founder Do Kwon and Terraform Labs are currently confronted with the dual threat of a class action suit in Singapore and a trial in the U.S. initiated by the Securities and Exchange Commission (SEC), both stemming from the collapse of TerraUSD. The unfolding legal saga adds further uncertainty to the future of Terraform Labs and its key figures.